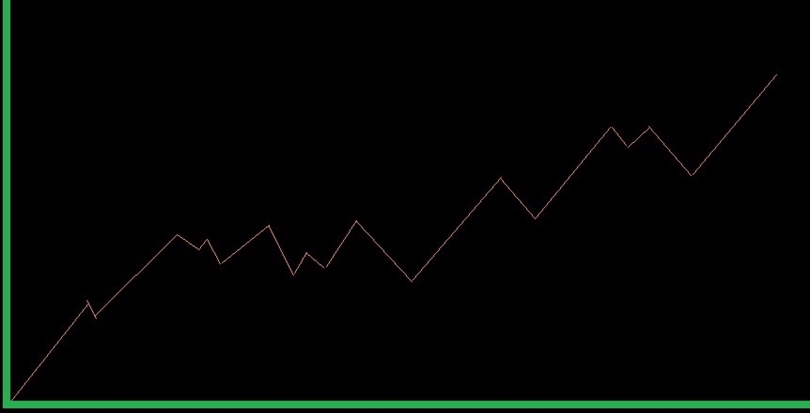

The pace in which we make progress is accelerating

The pace in which we make progress is accelerating. In the past it took years for companies to adapt to a changing market, but in modern times those who hesitate end up being late to the show. The stock market fluctuates more volatility than it used to, and this can make us rich or bankrupt us depending on our investment decisions.

Product Availability

Most of us grew up in an America where you could walk to the store and get whatever you needed in a timely manner. Shelves were typically fully stocked and special-order items could be produced in a reasonable amount of time. All of this changed in the spring of 2020 when most of America shut down for many weeks. Most manufacturers stopped producing and many companies held off on importing goods from overseas. This was done out of an abundance of caution. Big business did not want all its resources tied up in products that might not be needed. However, this shut down changed how the entire country lived. The types of goods we needed changed and the quantity of them available was not sufficient. Things sold out and some companies are still struggling to keep up with the new demand patterns. This problem creates a large amount of risk and opportunity for business owners and investors.

No Such Thing as an Easy Investment

The easiest assumption to make is that we should invest in producers of goods that are currently in high demand, however, this logic is flawed. Producing or importing goods from an overseas factory takes time and if you are one of the last companies to get your products to the shelves there is a good chance that the market has already been saturated. Just ask the people who invested their entire life savings into toilet paper. Sure, they made some quick and easy money, but most of them got stuck with way too much devaluing product once the major producers caught up. This leads to the most common problem when deciding what companies to invest in. Deciding when the right time to invest and when the right time to sell is? We all want to purchase stocks or fill a warehouse when prices are favorable and sell out when prices are high. However, there is no real way to predict what the future holds and sometimes a safe bet backfires.

Processing Time

If a friend is telling you about a great investment or you see on the news that a certain stock price is soaring, odds are you are already too late to capitalize. The people who make money investing are those ahead of the news cycles. That is why financial planning can be difficult. There are always safe investments like government bonds and established companies, but these investments result in slow returns. The way to make quick money is to buy low and sell high, but if it were easy everyone would do it. Globalization, the internet, and telecommunications have created an environment where companies can grow real big real fast, but they can also collapse even quicker. One day a stock price will be soaring and the next day the same stock could be worthless. We do not get enough time to process all the information and that is where the real risk lies in any investment. If you take too long to decide or if you make a choice too quickly you could lose big.

One of the best ways to make money is to invest money; however, there is always risk involved. No one makes the right decision 100% of the time and luckily, we do not have to. We just must win more often than we lose. We must not put all our eggs in one basket, and we must diversify. If we make solid plans and quality decisions, there is money to be made in any economic climate. We are fortunate that the modern economy moves quickly, this gives us countless opportunities. So, if you feel like you missed big on an investment, just remember there will always be another opportunity.