Credit is Complicated

Credit is complicated. It is a necessary evil that makes our economy work. If used wisely it can help us get things we both want and need immediately and allows us time to acquire the necessary financial capital to pay for them. Lines of credit allow us resources like water and gas and provide us access to cars and homes without having a large amount of cash available. In contrast, credit can also cause a lot of problems. Eventually we must pay for everything we have and use and borrowing more has caused financial hardship for millions of people.

Necessary Credit

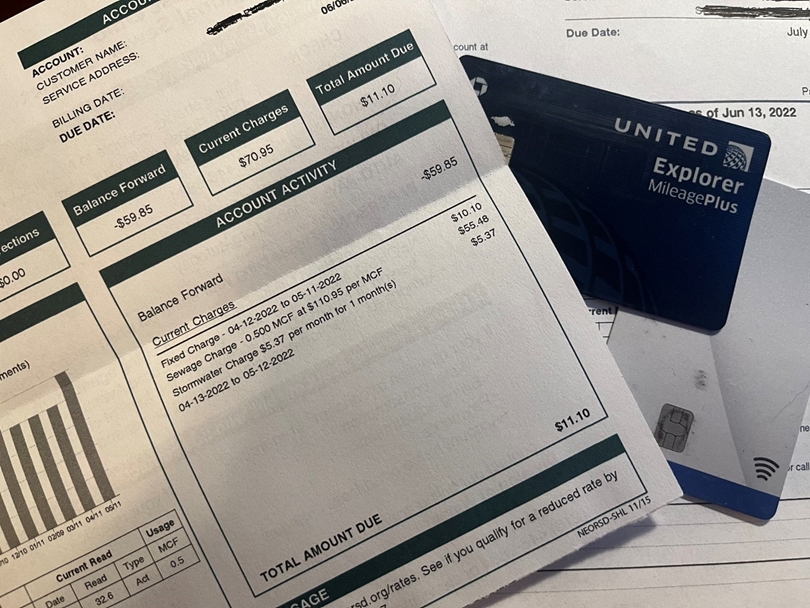

A simple way to avoid getting into credit debt problems is not to borrow at all; however, this not possible for most people in the modern economy. Very few people have the financial resources to purchase a car or home with cash. Additionally, most utility companies are no longer set up to run a pay before use system. Banks provide loans and use large items like houses and land as equity. If a homeowner defaults on their payments the house and land will be foreclosed and the bank will eventually auction the property to get whatever value they can out of the situation. Credit is also a valuable step in prequalifying a person for a rental unit or apartment. Rental companies want to make sure you can consistently pay for your property over the terms of a lease and most require credit checks to make sure they are protected against the problem of having a tenant who is not paying rent. Additionally, cars can be purchased using credit or leased on the basis of your paying for the time used every month. This is just another form of credit. It is easier for the average American to pay for their transportation needs monthly versus up front. Finally, energy and water consumption very based on seasons and weather conditions. This is why utility companies bill for their services after the fact. They are assuming you will pay for what you use afterwards. This is another form of providing credit. Without these basic forms of credit our economy will not function.

Loans

There are numerous types of personal and professional loans that help move our lives forward that are also forms of credit. The first one that comes to mind is a home improvement loan. Home repair can be costly and sometimes we need help paying for the necessary work that must be done. Fixing a leaky roof, replacing a broken driveway, waterproofing a basement, are just a few examples of home improvements that must be done and can cost a lot of money. Often times homeowners do not have the cash to pay for this work up front and a home improvement loan will be necessary. This can be done through a bank or a credit burrow. Put simply a home improvement loan is putting a second mortgage on your house where you use the homes equity and value as collateral. Also, most repair companies will have a financing option as well. Financing is essentially another form of credit. While most people want to avoid taking on the burden on this additional loan, sometimes it is unavoidable. Mortgaging the value of your home seems risky but it is safer than allowing a house to deteriorate and lose value and is often times the best option for a family.

Credit Cards and Payday Loans

The riskiest type of loans are credit cards and pay day loans. Firstly, credit cards have become an integral part of the economy. The use of cash continues to decline and the rise of ecommerce has made the importance of accepting digital payment via credit card essential to modern life. The real danger here is it is easy to spend beyond our means and run up a massive debt in a short period of time. The country is full of people who made this mistake with their first credit card. Teenagers and young adults often do not think about the big picture when they go shopping. It can take a person years to fix their credit based on early mistakes; however, it is possible and there are companies that can help. Consolidating debt created by youthful mistakes can help someone come up with a path to repair their credit score and can help teach people how to be responsible with money. That being said, as a rule it is important to always think things through. If you want something it is okay to purchase it as long and you have a plan to pay it for it at the necessary time. Pay day loans and daily pay programs have become more popular each year. These companies give you an advance on your next pay check for a fee. This can be useful is some situations; however, this can be dangerous. If you borrow too much and cannot pay on time the interest rates can be extreme. Additionally, borrowing against future pay checks makes saving extremely difficult. There is a time and place for payday loans and credit cards, just make sure not to overuse them and remember that you must eventually pay for what you borrow.

Credit is extremely important, without it our economy will not work. We must be responsible with this financial tool and we must be responsible when borrowing. Making a mistake could end up costly in the long run. Our credit score controls our credit rate and being an unreliable borrow only increase the cost of borrowing money and ensures we get less bang for our buck. Next time you see something you want, spend a few minutes to think if spending the money is the right thing to do. We only live once and we should buy things to make our lives more pleasant, just not at the expense of our financial future.